In addition to the aged, blind, and disabled populations, residents who meet the below requirements are eligible for Medical Assistance, which is the name of Minnesota’s Medicaid program: 1 (Note that the following eligibility limits include a built-in 5% income disregard that’s used for Medicaid eligibility determination for these populations.)

of Federal Poverty Level

Enroll online at MNsure. Call 1-855-366-7873 for help enrolling. Enroll in person at your County Human Services office.

Eligibility: Children up to 1 year with household income up to 283% of FPL. Children ages 1-18 with household income up to 275% of FPL. Pregnant women with household income up to 278% of FPL. Adults with household income up to 138% of FPL; adults with income between 138% and 200% of FPL qualify for MNCare.

In February 2013, then-Governor Mark Dayton signed HF9, a bill that expanded access to Medicaid Assistance (Minnesota’s Medicaid program) under the ACA.

HF9 eliminated the asset test for Medicaid eligibility (required under the ACA) and increased the upper income threshold for Medicaid eligibility for adults to 138% of the federal poverty level (133% plus a 5% income disregard, which is standard under the ACA).

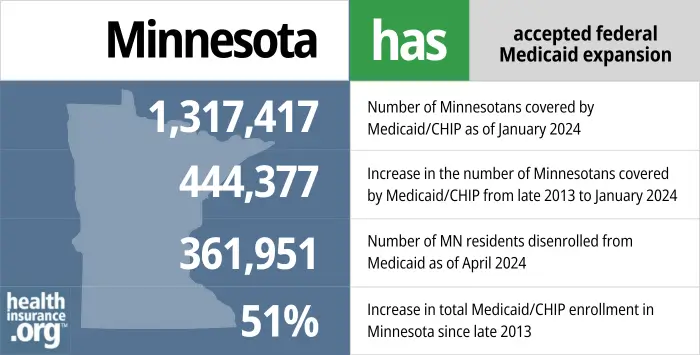

As of early 2024, nearly 267,000 Minnesota residents were enrolled in expanded Medicaid (this is the childless adult population). 1 Total Medicaid/CHIP enrollment, including the expansion population, stood at more than 1.25 million at that point. 1

Minnesota’s Medicaid enrollment in the fall of 2023 was 54% higher than it had been in the fall of 2013. That growth is due primarily to Medicaid expansion and the COVID pandemic. Enrollment is still much higher than it was pre-ACA, but has declined from the high point it reached in early 2023, due to the resumption of Medicaid disenrollments starting in mid-2023.

Before 2014, Medical Assistance in Minnesota was available to parents with dependent children if their household income was up to 100% of poverty, and to adults without dependent children if their household income was up to 75% of poverty. Minnesota was already very progressive in providing Medicaid access for most of the state’s low-income population — in many states there was no coverage at all for childless non-disabled adults before 2014, and in nine states that haven’t expanded Medicaid under the ACA, there still isn’t.

The federal government pays 90% of the cost of covering the newly eligible Medicaid population, while the state covers the other 10%.

We’ve compiled this guide to help you choose the right health insurance plan for you and your family. An ACA Marketplace/exchange plan – or Obamacare – is a good option for many people who don’t have access to Medicare, Medicaid, or employer-sponsored health insurance. We’re here to walk you through the choices available.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Minnesota.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Minnesota as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage.

If you’re under 65 and not on Medicare:

If you are 65 or older or have Medicare, visit one of these websites (seniors and people with disabilities) for help applying for Medicaid.

Many Medicare beneficiaries receive assistance through Medicaid with the cost of Medicare premiums, co-pays, deductibles, and services not covered by Medicare — such as long-term care.

Our guide to financial assistance for Medicare beneficiaries in Minnesota explains these benefits, including Medicare Savings Programs, Extra Help, long-term care coverage, and income guidelines for assistance.

During the COVID pandemic, from March 2020 through March 2023, Medicaid disenrollments were paused nationwide. But that rule ended March 31, 2023. Medicaid disenrollments resumed in Minnesota in July 2023, and by January 2024, more than 177,000 people had been disenrolled from Medicaid in Minnesota. 6

Minnesota has kept enrollees’ existing renewal date, based on when people enrolled (renewals are normally conducted every 12 months, but that wasn’t the case during the pandemic), rather than prioritizing renewals for people expected to no longer be eligible. 7

People with MinnesotaCare (the state’s Basic Health Program, discussed in more detail below) received their renewal notices in October 2023, for coverage effective in January 2024. 7 Renewals for Medical Assistance (Medicaid) are being spread out across twelve months, from July 2023 through June 2024 (after that, normal routine annual eligibility redeterminations will continue to be used for all enrollees, but there will no longer be a backlog of people whose eligibility was pended during the pandemic).

People who are no longer eligible for Medicaid may find that they’re eligible for MinnesotaCare instead. And people who aren’t eligible for either program are likely to be eligible for either an employer’s health plan or a subsidized policy through MNsure, the state-run exchange.

Minnesota enacted SF2265 in 2023, which ensures that for Medical Assistance enrollees who are subject to asset tests, including those age 65 and older, assets will be disregarded during their first renewal after the pandemic-era continuous coverage period, and will not be taken into consideration until their second annual renewal. 8

SF2265 initially included various other provisions designed to ease the transition from the pandemic-era continuous coverage rule, including additional state-funded cost-sharing reductions for MNsure plans, and continuous coverage Medicaid rules for children under the age of six. But those provisions were not included in the version of the bill that was enacted. 8

Minnesota’s Medicaid program has utilized estate recovery (required under state and federal law) since 1967 as a means of recouping Medicaid costs after an enrollee dies. The estate recovery program applies to people who were 55 or older at the time they incurred Medicaid claims, and the program allowed the state to place liens against the enrollees’ estates, so that some or all of the money would be paid back to the state.

Before the ACA, the vast majority of adults 55 or older who were covered by Medicaid were elderly, low-income residents who needed long-term care (Medicare does not cover long-term care, but Medicaid does if the person’s income and assets are low enough). But starting in 2014, large numbers of residents — many of whom were 55 or older — became eligible for Medicaid, and many were caught off-guard when they found out that liens were being filed against their estates.

Lawmakers addressed the issue in 2016, amending the state’s existing protocol for Medicaid estate recovery. The state announced that pending federal approval, Medicaid estate recovery in Minnesota would be limited to cases in which long-term care was covered. The state intended to make that change retroactive to January 2014, but CMS did not approve that. Instead, the new rules, which limit estate recovery to long-term care costs, apply to estate claims that were pending as of July 1, 2016, and to the estates of people who die after July 1, 2016.

In addition to Minnesota Medicaid, the state supports MinnesotaCare (MNCare) for residents with incomes above 138% of poverty, up to 200% of poverty.

As of early 2024, there were 116,336 people enrolled in MinnesotaCare. 1

Unlike Minnesota’s Medicaid program, MNCare has a small monthly premium that ranges as high as $28 (this was as high as $80/month before the American Rescue Plan increased federal health insurance subsidies). The premium is calculated on a sliding scale and does not apply to most enrollees; most enrollees do not have to pay a premium, although it depends on where they are on the income scale.

The preferred enrollment method for MinnesotaCare is through MNsure, and enrollment in Minnesota Medicaid and MinnesotaCare is open year-round.

As noted above, disenrollments for MinnesotaCare were paused during the pandemic, just like disenrollments for Medicaid. But MinnesotaCare renewals (and disenrollments) resumed in October 2023, for coverage effective in 2024. 7

MNCare has existed in Minnesota since 1992, but it became a much more robust program in 2014. As of January 2015, MinnesotaCare transitioned to a Basic Health Program under the ACA. BHPs are a provision of the ACA that any state can implement, but Minnesota was the only state to do so in 2015. New York established a BHP, effective January 2016, and Oregon plans to have a BHP by mid-2024.

Numerous improvements were made to MNCare effective January 1, 2014. The program no longer has a $1,000 copay for hospitalization, or a $10,000 cap on inpatient benefits. The asset test has been eliminated just as it was for Medicaid, and premiums have been significantly reduced. It used to be available only to applicants who had been uninsured for at least four months, but that provision was eliminated in 2014.

Federal funding for MinnesotaCare (and New York’s BHP, The Essential Plan) was reduced when the Trump administration cut off funding for cost-sharing reductions. The two states sued, and in August 2018 the federal government agreed to restore most of the federal funding for 2018.

In the fall of 2013, prior to the launch of the ACA’s exchanges, Minnesota’s total Medicaid/CHIP enrollment stood at 873,040.

As of late 2023, there were a total of 1,348,186 people enrolled in Medicaid/CHIP in Minnesota. 9 Most of these enrollees (1,251,702) were enrolled in managed care programs as of early 2024. Nine managed care plans support Minnesota’s Medicaid and MinnesotaCare programs: Blue Plus, Health Partners, Hennepin Health, Itasca Medical Care, Medica, PrimeWest Health, South Country Health Alliance, UCare, and UHC-MN. 1

Minnesota was one of the six states that enacted Medicaid as soon as the program became available, in January 1966.

In the 1980s, to control costs, Minnesota began implementing PMAP, or pre-paid medical assistance programs. PMAPs provide blocks of Medicaid funding to non-profit HMOs and a variety of rural health programs across the state. The program was instituted as a demonstration project in 1983 and continued to be the mechanism by which Medicaid funds are dispersed to providers in Minnesota for decades.

The Minnesota Department of Human Services was tasked with setting rates for the payments that HMOs receive in the Medicaid PMAP. Over the years, there have been improvements made to ensure that the various participating HMOs are using uniform reporting methods for their administrative expenses.

Minnesota had some of the country’s most generous eligibility guidelines for Medicaid before expansion under the ACA (up to 100% of poverty for adults with dependent children, and up to 75% of poverty for those without dependent children). The state also became the first in the nation to establish a Basic Health Program under the ACA.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.