Policies to reduce poverty

In summary, to reduce poverty, government policies could include:

- Means-tested welfare benefits to the poorest in society; for example, unemployment benefit, food stamps, income support and housing benefit.

- Minimum wages. Regulation of labour markets, for example, statutory minimum wages

- Free market policies to promote economic growth – hoping that rising living standards will filter down to the poorest in society.

- Direct provision of goods/services – subsidised housing, free education and healthcare.

There are two major types of poverty:

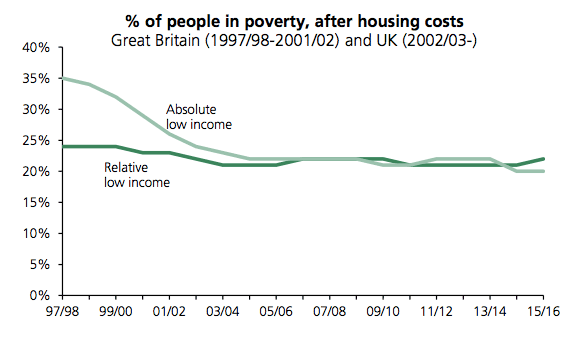

- Absolute poverty – when people have insufficient income to afford the necessities of life, such as food, rent and clothing.

- Relative poverty – when people have income significantly less than the average income for society.

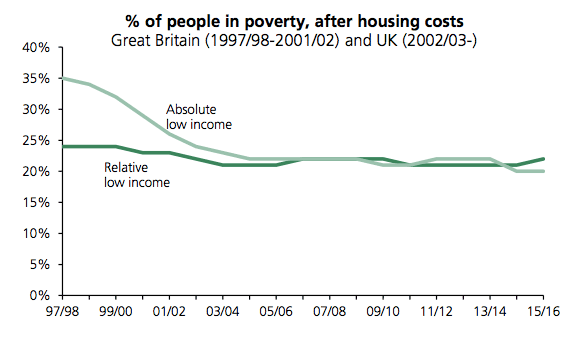

Some policies, such as promoting economic growth may be successful in reducing absolute poverty but less successful in relative poverty.

Economic policies in more detail

1. Sustained economic growth

The argument is that promoting economic growth increases total income in society, creating more jobs and income which could be redistributed. In the past 100 years, economic growth has been a major factor in reducing the levels of poverty which were seen in pre-war Britain and the US. However, it is not necessarily the case that income and wealth will trickle down to the poorest. There is a concern that economic growth could widen relative poverty because it benefits the highly skilled and wealthy classes more than those at the bottom. See: Inequality and economic growth

2. Reduce Unemployment

Unemployment is a major cause of poverty because the unemployed have little income, relying on state benefits. Unemployment can be reduced through both supply-side policies, such as free training schemes for those who are structurally unemployed.

Poverty and unemployment are often geographical problems, with depressed areas seeing higher levels of poverty. Policies to overcome geographical poverty could include government subsidies for firms to set up in depressed areas. Also building better infrastructure (transport and communication) in depressed areas can provide an economic stimulus to create new jobs.

3. Progressive Taxes

Increasing progressive taxes, such as the higher rate of income tax from 40% to 50%, will take more income from those on high-income levels. This enables cuts in regressive taxes (e.g. VAT/Sales tax) and increased welfare benefits which help increase the income of the poor. This can be an effective way to reduce relative poverty.

- However, critics argue higher income taxes create a disincentive to work., leading to less output. This is because higher tax makes work less attractive and reduces the opportunity cost of leisure. Therefore people work less and enjoy more leisure. This is known as the substitution effect. Similarly higher corporation tax may discourage investment in the UK

- However, this is disputed by other economists, who point out that higher tax reduces incomes and this may encourage people to work more, to maintain their income. (This is known as the income effect)

- Evidence suggests that higher income tax has little incentive on the supply of labour, suggesting labour supply is relatively inelastic. However, it also depends at what level income tax is set. There is certainly a level where higher income tax will reduce incentives to work.

- Other problems with increasing income tax, include tax evasion and the fact firms may adjust wages to compensate for the higher taxes.

4. Increasing benefits to the poor

Means-tested benefits involve increasing welfare benefits to those on low incomes. For example, universal tax credit, food stamps or child benefit.

Advantages of means-tested benefits:

- They allow money to be targeted to those who need it most. e.g family tax credit or pension credit.

- It is cheaper than universal benefits and reduces the burden on the taxpayer.

However, the problem with using benefits to reduce poverty include:

- Means-tested benefits are often unpopular because people are stigmatised as being poor.

- Also, it may create a disincentive to earn a higher wage because if you do get a higher paid job you will lose at least some of your benefits and pay more tax. This is known as “the benefits trap” or the “poverty trap”. The poverty trap occurs where people on low incomes are discouraged from working extra hours or getting a higher paid job because any extra income they earn will be taken away in lost benefits and higher taxes. To avoid the poverty trap the government can grade benefits so that there isn’t an immediate cut off point.

- Some relatively poor may fall just outside the qualifying limit.

- Also, not everyone entitled to means-tested benefit will collect them because of ignorance or difficulties in applying.

The government used to prefer universal benefits because it avoided the above problem, and people feel if they contribute towards taxes they deserve their benefits regardless of their wealth.

However, in recent years, the welfare state has faced increased demands due to demographic factors leading to more calls for means-tested benefits.

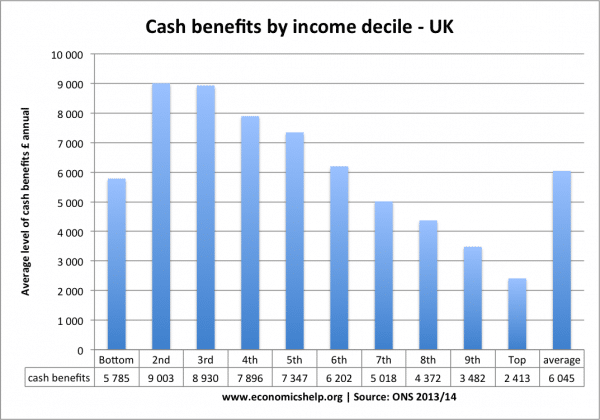

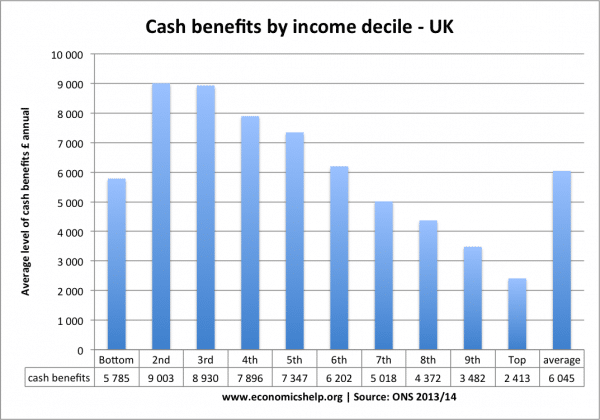

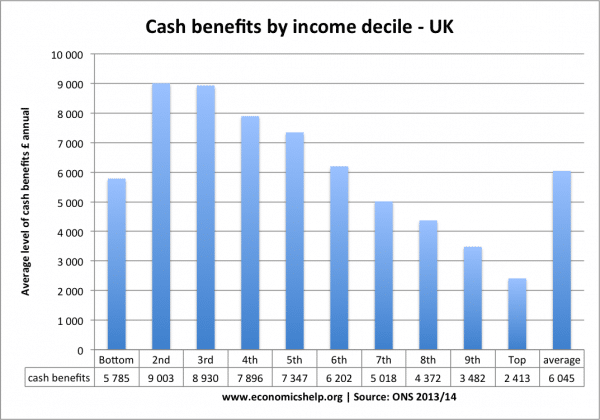

Cash benefits by income decile. Show the poorest don’t receive the most benefits.

5. National Minimum Wage The government could increase the national minimum wage. This is an effective way of increasing the incomes of the low paid and therefore reducing wage inequality. A related concept is the Voluntary Living Wage – an attempt to encourage firms to pay higher wages.

In recent years, minimum wages have become more important in tackling in-paid work in both the UK and US.

- In the UK, the number of workers benefitting from the minimum wage has increased from 830,000 in 1999 to 2 million in 2018.

- In the US, there is a proposal to increase federal minimum wage to $15 by 2024 – a move that could see 33.5 million U.S. workers and 6.2 million workers in poverty see a rise in the minimum wage.

- A potential problem of increasing the minimum wage is that it may cause unemployment because firms may not be able to afford the workers. If it does cause unemployment, poverty could worsen. However, if firms have monopsony power, then they will be able to afford higher wages. Empirical evidence suggests that we can increase minimum wages fairly significantly before the cost of falling employment and higher prices outweigh the benefit of rising wages and higher productivity. See more on raising the minimum wage

6. Benefits in kind. These are important public services which are provided free at the point of use (or subsidised). They mainly involve education and health care. Free education enables those from low-income families to gain skills and qualifications which can help lead to better jobs and higher incomes in the future.

7. Universal basic income (UBI) A universal basic income or citizen’s income involves giving every citizen a weekly benefit – regardless of circumstances and income. The idea is to ensure everyone has a minimum income guarantee, but without any disincentives of losing means-tested benefits from working more. See more at Universal basic income (UBI)

Policies to reduce poverty in developing economies

To reduce poverty in developing economies, the focus may be on different policies.

- Education – greater spending on education and training can enable higher-skilled workforce.

- Foreign Aid – aid from developed countries can be used to invest in better health care and education. However, some argue aid can encourage dependency.

- Diversification of economy away from agriculture to manufacturing. This enables greater economic development but may be difficult to do without the right skills and infrastructure.

- Policies for economic development

Poverty levels in the UK

Related

- Will increasing the minimum wage reduce poverty?

- Policies for improving economic development

- Should welfare benefits be increased to reduce poverty?