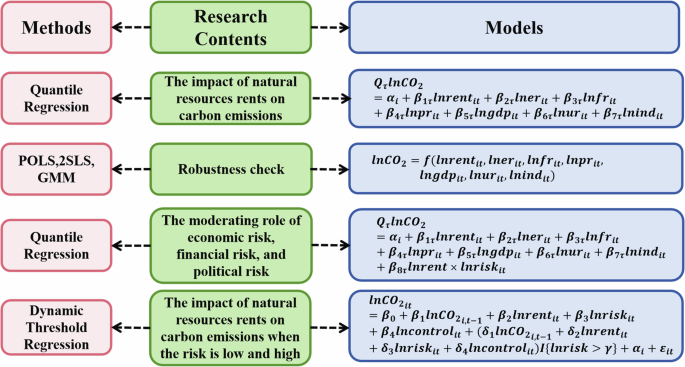

Effective management of natural resources is crucial for diminishing carbon emissions. This research explores how economic, financial, and political risks influence the relationship between natural resources rents and carbon emissions. Analyzing data from 66 countries, this study utilizes methods such as quantile regression and dynamic threshold regression to thoroughly assess the data. The findings reveal: (i) Natural resources rents tend to increase carbon emissions consistently across different quantiles (0.1 to 0.9). The fact is confirmed by robustness checks, illustrating that increased natural resources rents lead to higher emissions. (ii) Economic, financial, and political risks affect how natural resources rents impact carbon emissions. Notably, reduced economic and financial risks lessen the propensity of natural resources rents to boost emissions at higher quantiles, while a decline in political risk decreases the exacerbating effect of natural resources rents on emissions from the 0.1 to 0.9 quantiles. (iii) This analysis uncovers threshold effects where economic, financial, and political risks act as threshold factors. Specifically, when economic and political risks are low, a rise in natural resources rents actually leads to a decline in carbon emissions. The findings underscore the importance of considering these risks in the formulation of policies aimed at reducing carbon emissions from natural resource exploitation.

Greenhouse gases, predominantly carbon dioxide, play a significant role in climate change. Climate warming leads to an increase in extreme weather events and makes natural disasters such as floods more frequent (Zeng et al. 2023). Carbon emissions are unavoidable byproducts of industrial production and household consumption. Natural resources rents encompass the economic gains that a nation obtains through the ownership, extraction, and deployment of its natural resources. The act of extracting and utilizing these resources is a significant source of carbon dioxide emissions. Therefore, nations rich in natural resources like oil, coal, and natural gas typically experience higher levels of carbon emissions per GDP unit than nations with fewer natural resources (Chiroleu-Assouline et al. 2020). This situation is often referred to as the “carbon curse” associated with natural resources. Countries possessing extensive natural resource reserves are likely to have more carbon-intensive industries and face more severe environmental pollution challenges (Friedrichs and Inderwildi, 2013). This can be partly attributed to the “Dutch disease” effect, where the abundance of natural resources might stifle the growth of other economic sectors, leading to a carbon-intensive energy and industrial structure (Friedrichs and Inderwildi, 2013).

The COVID-19 pandemic and the ongoing Russia-Ukraine conflict have profoundly reshaped the economic and social landscape, significantly influencing global energy supplies and geopolitical dynamics. These events have not only heightened economic risks but also had a substantial impact on carbon emissions, as noted in recent studies by Adebayo et al. and Zheng et al. (Adebayo et al. 2023a; Zheng et al. 2023). A substantial body of research has explored how various risk factors, including economic uncertainty and geopolitical tensions, affect carbon emissions. For example, works by Syed et al. as well as Adams et al. have highlighted these influences (Syed et al. 2022; Adams et al. 2020). Such risk factors disrupt normal business operations and may hinder enterprises’ commitment to green technology innovation and investments in environmentally friendly projects, leading to the delay of green initiatives and adversely affecting environmental quality and sustainable development. Over time, these accumulated risks could potentially lead to an increase in carbon emissions.

The International Country Risk Guide (ICRG) evaluates risks from three dimensions: economic, financial, and political (ICRG, 2023). Economic risks assess the balance between the advantages and disadvantages of a country’s economic growth. A predominance of disadvantages indicates higher economic risks, which can increase business uncertainty and hinder technological innovation, potentially leading to negative environmental impacts (Wang et al. 2023a). Conversely, reduced financial risks enhance a country’s ability to raise more sufficient funds for business and trade, which can support research in green technologies and investments in green projects. This investment is crucial for improving environmental quality and reducing carbon emissions, but this requires the government to direct funds to green projects in order to achieve carbon emission reduction (Liu and Song, 2020). However, excessive financial risks can paradoxically lead to a temporary decrease in emissions, as observed during the global economic downturn in 2008–2009, when reduced industrial activity led to lower carbon output (Liu and Song, 2020). Political stability, indicated by low political risk, empowers governments to enact more effective carbon reduction policies. Conversely, high political risk often correlates with governmental instability, which can disrupt environmental policy implementation. In urban areas that implement key air pollution prevention measures and measures targeting specific environmental issues, natural resources rents have no increasing effect on carbon emissions. Broad environmental regulations are generally effective in achieving reduction of carbon emissions (Che and Wang, 2022; Fan et al. 2022).

Countries globally exhibit varied stages and levels of carbon emission reduction, with significant disparities across regions. Figure A1 illustrates the carbon emission levels in different countries in 1990, 2000, 2010, and 2020, clearly depicting the heterogeneity in carbon emissions internationally. This variation is notable when analyzing the influence of natural resource rents on carbon emissions. Traditional studies on this subject often rely on mean regression, which might not capture the nuanced impacts across different emission levels. To address this gap, this study employs quantile regression, specifically using a nine-quantile approach. This method allows for a more comprehensive analysis of how natural resources rents affect carbon emissions across various quantiles, offering a deeper understanding of these relationships at different emission intensities.

This research extends prior analyses by posing a series of investigative questions. The central inquiry focuses on the influence of revenues from natural resources on different levels of carbon emissions. This study also considers risks in three aspects: economy, finance, and politics, and examines how mitigating economic, financial, and political uncertainties can alter the connection between natural resources rents and carbon emissions across various emission tiers. Additionally, the research delves into how the impact of natural resources rents on carbon emissions varies under different levels of economic, financial and political stability. To thoroughly investigate these dynamics, the study utilizes data spanning three decades, from 1990 to 2020, and encompasses a sample of 66 countries.

This study contributes to scholarly discussions by offering several unique perspectives. It applies quantile regression techniques to investigate how natural resources rents affect carbon emissions at various intensity levels, from the 10th to the 90th percentile. Additionally, this research delves into the moderating roles of economic, financial, and political risks, analyzing how they influence the relationship between natural resource and carbon emissions at different emission quantiles. Moreover, the research incorporates a dynamic threshold model to identify potential changes in the nexus between natural resource and carbon emissions at specified risk thresholds. This study finds that natural resource increase carbon emissions at all levels. Economic risks, financial risks and political risks have a moderating effect on the relationship between natural resource and carbon emissions. And when economic and political risks are low, natural resource can reduce carbon emissions. The findings of this study provide valuable contributions to sustainable natural resource management and the development of effective risk management strategies at a national scale.

The structure of this article is organized as follows: The second section reviews relevant literature. The third section describes the data and methodologies employed. The fourth section presents the results of the empirical analysis, discusses the results and offers policy implications. The final section concludes the research and outlines its limitations.

Over-reliance on natural resources can significantly increase carbon emissions. Agboola et al. found that in both the short and long term, natural resource rents substantially boosted Saudi Arabia’s carbon emissions, highlighting the environmental costs of excessive dependence on these resources (Agboola et al. 2021). Similarly, Huang expanded the research framework to include financial development and urbanization, observing that in the United States, natural resource rents exacerbated carbon emissions and degraded environmental quality (Huang, 2022). Liu et al. examined the Group of Seven countries using quantile regression and discovered that natural resource prices elevated carbon emissions across all studied quantiles, suggesting that extensive resource exploitation diminished environmental quality through increased air pollution (Liu et al. 2022). Aladejare analyzed the impact of natural resource on environmental degradation in Africa’s wealthiest economies, revealing that natural resource rents lowered environmental standards (Aladejare, 2022). Further, Nwani et al. explored the dual impact of natural resource rents on carbon emissions from both production and consumption perspectives, finding that economic reliance on these resources increased emissions in both domains (Nwani et al. 2023). Lastly, Liu et al. stressed that while over-exploitation of natural resources harmed environmental quality, the promotion of clean energy and sustainable resource use can enhance ecological environment (Liu et al. 2023).

Effective management of natural resources can lead to improved environmental condition (Adebayo et al. 2023b). Research conducted by Alfalih and Hadj on the dynamic impacts of natural resource rents on environmental sustainability in Saudi Arabia suggested that although these rents could lower carbon emissions and enhance the atmospheric environment, they presented challenges to maintaining dynamic environmental sustainability (Alfalih and Hadj, 2022). Additionally, a study by Chen et al. on the effects of natural resource rents in highly polluting nations showed that these rents positively affected ecological efficiency, demonstrating a one-way causal relationship (Chen et al. 2022). Moreover, research by Khan et al. on the relationship between natural resources, economic growth, and ecological footprints in OECD countries found that natural resources, while potentially hindering economic growth, had a beneficial impact on environmental quality (Khan et al. 2022).

Adams et al. conducted an empirical analysis in 10 resource-rich countries, revealing that economic uncertainty increased carbon emissions in both short-term and long-term, with a more pronounced impact on environmental degradation over the long term (Adams et al. 2020). The reduction in innovation investment may contribute to an increase in carbon emissions (Wang et al. 2023a). Similarly, Yu et al. analyzed how economic uncertainty in China’s provinces affected carbon emissions. They found that uncertainty significantly increased fossil fuel consumption, raised energy intensity in businesses, and stifled innovative activities, all of which contributed to higher carbon emissions (Yu et al. 2021). Furthermore, studies by Cui et al. highlighted the detrimental effects of economic uncertainty on innovation. Their research showed that in China, economic uncertainty reduced firms’ investments in innovation, potentially leading to increased carbon emissions (Cui et al. 2021).

The effects of economic uncertainty on carbon emissions were complex and varied under different conditions (Ayhan et al. 2023). Syed et al. investigated this phenomenon in the BRIC countries using quantile regression. Their findings indicated that economic uncertainty can decrease carbon emissions in the middle and low quantiles, whereas it tended to increase emissions in the higher quantiles (Syed et al. 2022). Similarly, Anser et al. explored the short-term and long-term impacts of economic uncertainty on carbon dioxide emissions among the world’s top ten carbon emitters. They observed a reduction in emissions in the short term, but an increase over the long term (Anser et al. 2021). Another study focused on emerging countries, examining the effects of economic uncertainty and geopolitical risks. In the E-7 countries, economic uncertainty was found to be detrimental to the environment in the short term but beneficial in the long term, likely because high economic risks can reduce production and consumption, thus lowering fossil fuel usage (Chu et al. 2023). Additionally, Adebayo et al. assessed the impact of national risks on environmental quality in Mexico, Indonesia, Nigeria, and Turkey from 1990 to 2018. Their research concluded that economic risks generally enhanced environmental quality, suggesting a complex interplay between national economic conditions and environmental impacts (Adebayo et al. 2023a).

A stable financial market can not only support more investment and financing activities but also facilitate investments in green projects, thereby reducing carbon emissions (Pata et al. 2023). Hussain et al. discovered that financial development in China led to a reduction in both carbon emissions and ecological footprints (Hussain et al. 2022). Similarly, Wang et al. examined the ASEAN region and concluded that an increase in financial risks adversely affected environmental quality (Wang et al. 2023c). Further insights came from Ahmad et al. who analyzed panel data from emerging countries spanning 1990 to 2018. They found that decreasing financial risks significantly lowered carbon dioxide emissions (Ahmad et al. 2023). This observation was supported by another study by Ahmad et al. which focused on OECD countries from 1984 to 2018. The results indicated that improvements in financial conditions reduced ecological footprints, primarily because reduced financial risks contributed to financial development. This, in turn, provided more robust support for renewable energy development, which played a crucial role in lowering carbon emissions and enhancing environmental quality (Ahmad et al. 2022).

Countries with low financial risks are better positioned to develop financial markets, however, such expansion may paradoxically lead to increased pollution. Qalati et al. investigated the impact of financial development on carbon emissions across both developed and developing nations. Their findings indicated that financial expansion contributed to higher carbon emissions in these regions (Qalati et al. 2023). Ling et al. focused on China, analyzing the effects of financial development on carbon emissions from 1980 to 2017, they observed that financial development, which often requires significant energy consumption, tended to increase carbon emissions over the long term (Ling et al. 2022). Additionally, Qin et al. utilized time series data from China spanning 1988 to 2018 to differentiate the effects of financial development and financial risks on carbon emissions. Their study suggested that while financial development supported environmental protection projects and thus had a negative relationship with carbon emissions, financial risks tended to decrease economic activity, which can reduce carbon emissions (Qin et al. 2021). Adebayo et al. further explored the influence of national financial risks on environmental quality in Mexico, Nigeria, Indonesia, and Turkey. Their research supported the notion that an increase in financial risks reduced carbon emissions and confirmed a unidirectional causality from financial risks to carbon emissions (Adebayo et al. 2023a).

Numerous studies have explored the relationship between political risks and carbon emissions, yielding varied conclusions. Su et al. analyzed Brazil’s data from 1990 to 2018 and demonstrated that an improved political environment correlated with reduced carbon emissions (Su et al. 2021). Conversely, Ahmad et al. investigated emerging economies, highlighting that heightened political risks tended to escalate carbon emissions (Ahmad et al. 2023). The high level of political risk implied that the country’s institutions were of low quality and that the government may not have the capacity to develop policies to support sustainable development (Ahmad et al. 2023). Well-established institutions had a positive effect on carbon mitigation (Xia et al. 2022). Nations with robust governance frameworks were better poised to enact sustainable policies, as indicated by Khan et al. (Khan et al. 2021). Tang et al. emphasized the negative influence of political risks on a country’s environment, because political stability was threatened (Tang et al. 2022). Depren et al. found that political risks exerted a negative influence on environment (Depren et al. 2023). Danish and Ulucak underscored the positive impact of institutional enhancements on environmental quality across APEC nations (Danish and Ulucak, 2020). Furthermore, Dasgupta and De Cian stressed the indispensable role of government support in fostering green energy and clean technology (Dasgupta and De Cian, 2018). Corrupt and unstable governments found it difficult to develop a range of strategic plans to support sustainable development (Kartal et al. 2024; Kartal et al. 2022). The repercussions of corruption on environmental standards have been scrutinized extensively, notably in China. Zhou et al. observed a positive environmental shift amid China’s anti-corruption campaign (Zhou et al. 2020). While Chen et al. revealed a tangible link between corrupt practices and diminished environmental quality within Chinese provinces (Chen et al. 2018). Corruption undermined environmental oversight mechanisms, exacerbating pollution levels and hindering sustainable development efforts (Li et al. 2023).

Recent research underscored the impact of environmental policies on carbon emissions in cities with a focus on air pollution control. Fan et al. discovered that in such cities with environmental regulation, natural resources did not significantly elevate carbon emissions (Fan et al. 2022). Supporting this, Che and Wang found that environmental regulations can lessen the “carbon curse” associated with resource dependence (Che and Wang, 2022). Similarly, Yang et al. confirmed that these regulations moderated the rise in carbon emissions due to natural resource dependence (Yang et al. 2023). This effect was because environmental regulation enhanced the efficiency of carbon emissions in the natural resource sector, facilitating a transition to low-carbon production methods, as noted by Su and Xu (Su and Xu, 2022).

Political risks can significantly influence carbon emissions. Syed et al. explored the effects of geopolitical risks on BRIC nations’ carbon emissions, discovering that while such risks tended to increase emissions in the lower quartiles, they reduced emissions in the middle and upper quartiles (Syed et al. 2022). Extending this inquiry, Chu et al. investigated both short-term and long-term impacts of geopolitical risks on carbon emissions in emerging economies (Chu et al. 2023). They found that geopolitical risks initially increased carbon emissions but ultimately contributed to their reduction. Similarly, Nawaz et al. analyzed the factors affecting Italy’s carbon emissions and concluded that geopolitical risks generally decreased emissions, likely due to diminished economic activity during heightened political uncertainty (Nawaz et al. 2023). Kartal et al. examined the impact of political stability on carbon emissions in the UK and found that political stability had a greater positive than negative impact on carbon emissions (Kartal et al. 2023).

This review synthesizes prior studies on how natural resources rents and national risks influence carbon emissions, highlighting that these elements are often examined separately. Yet, the impact of national risks on the management and use of natural resources is profound, pointing out the importance of investigating how the risks alter the dynamics between resource use and carbon emissions. Moreover, while there is a considerable amount of literature focusing on political and geopolitical risks, economic and financial risks are markedly underexplored. Given the critical role of natural resources in national economic development, investigating economic and financial risks is essential for the sustainable development of natural resources.

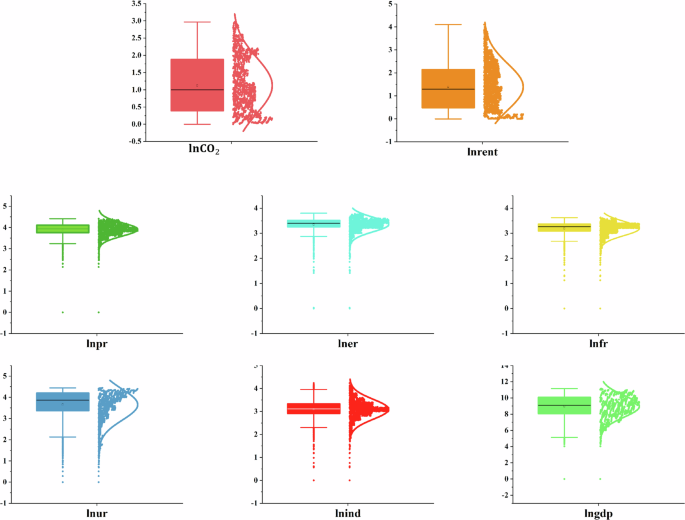

This research investigates how natural resources rents impact carbon emissions at different emission levels. This study further explores how economic, financial, and political risks may alter this interaction. In response to climate change concerns, the United Nations established the Intergovernmental Panel on Climate Change (IPCC) in 1988 (IPCC, 2023). Since 1990, the IPCC has released comprehensive assessment reports approximately every 5 to 7 years. These reports serve as references for global climate policies and are intended to inform both governments and the public. The dataset spans from 1990 to 2020, encompassing data from 66 countries. The study incorporates variables such as carbon emissions (dependent variable) and natural resources rents (independent variable), with economic risks, financial risks, and political risks serving as moderators. The study also includes urbanization, industrialization, and economic growth as control variables. The specifics and sources of these variables are outlined in Table 1. Figure 1 displays the distribution of each variable, emphasizing their non-symmetrical nature and the presence of outliers. To verify the credibility of the results, a Variance Inflation Factor (VIF) test was performed (Kalatzis et al. 2011). As documented in Table 2, all variables show a VIF below 5, confirming the absence of significant multicollinearity issues in the data set.

To confirm the accuracy of the quantile and threshold estimates, this study examines potential unit root issues using both first and second-generation unit root tests to evaluate variable stationarity. For the first generation of unit root tests, the Fisher-PP and Fisher-ADF methods are utilized to assess the stability of the variables. Additionally, the research acknowledges the influence of cross-sectional correlations on unit root test outcomes. To mitigate this, this research integrates a second-generation unit root test, specifically employing the CIPS method detailed by Pesaran (2007). The primary model used for the CIPS test is outlined as follows:

Based on this expression, the t ratio can be calculated from \(>>_>>(>,>)\) .